Four factors to consider when deciding to invest

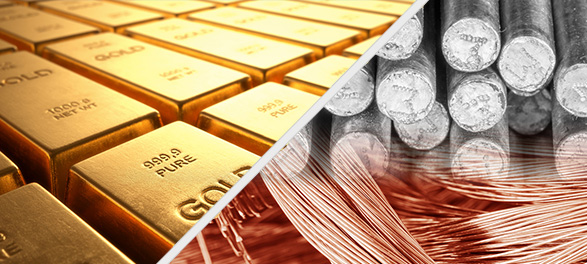

Looking for ways to prepare for future uncertainties? A solution for some may be investing in precious metals, such as gold and silver. Here’s what to know.

To varying degrees, both gold and silver may provide a hedge in a potential economic or market downturn, as well as during sustained periods of rising inflation. Understanding the difference between how the two metals are used, their economic sensitivities and technical characteristics can help you determine which metal may benefit your portfolio.

Here are four factors to consider when deciding to invest in gold or silver:

1. Silver May Be More Tied to the Global Economy

Half of all silver is used in heavy industry and high technology, including smartphones, tablets, automobile electrical systems, solar-panel cells and many other products and applications, according to the World Silver Survey. As a result, silver is more sensitive to economic changes than gold, which has limited uses beyond jewelry and investment purposes. When economies take off, demand tends to grow for silver.

2. Silver Is More Volatile than Gold

The volatility in silver prices can be two to three times greater than that of gold on a given day. While traders may benefit, such volatility can be challenging when managing portfolio risk.

3. Gold Has Been a More Powerful Diversifier than Silver:

Silver can be considered a good portfolio diversifier with moderately weak positive correlation to stocks, bonds and commodities. However, gold is considered a more powerful diversifier. It has been consistently uncorrelated to stocks and has had very low correlations with other major asset classes—and with good reason: Unlike silver and industrial base metals, gold is less affected by economic declines because its industrial uses are fairly limited.

4. Silver Is Currently Cheaper than Gold

Per ounce,silver tends to be cheaper than gold, making it more accessible to small retail investors who wish to own the precious metals as physical assets.

How You Can Invest in Gold and Silver

One of the attractions of gold and silver is that both can be purchased in a variety of investment forms:

- Physical Metals: Unlike stocks and bonds, gold and silver can be purchased as physical assets, as either bars and coins held as part of a Morgan Stanley brokerage account or as American Eagle coins held in a retirement account. The metals would be held by a third-party depository, not Morgan Stanley, though investors can take physical delivery if they want to store it themselves.

Holding bars and coins can have downside, though. For one, investors often pay a premium over the metal spot price on gold and silver coins because of manufacturing and distribution markups. Storage and even insurance costs should also be considered.

- Exchange-Traded Funds: ETFs have become a popular way for investors to gain exposure to gold and silver, without having the responsibility of storing a physical asset. You can buy shares and keep them in a traditional brokerage account. The fund’s operator is responsible for handling the costs of holding a physical supply of gold or silver and charging an expense ratio. But investing in an ETF doesn’t give investors access to the underlying metals. Also, some precious-metal ETFs are taxed as collectibles and don’t benefit from lower long-term capital gains rates.

- Mining Stocks and Funds: Some investors see opportunity in owning shares of companies that mine for gold and silver, or mutual funds that hold portfolios of these miners.